Investors Pay Attention To Risk Again

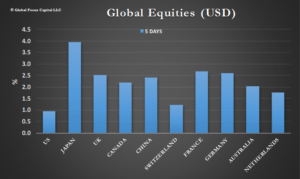

- Risky assets suffered large losses last week with the exception of REITS up over 3%

- Fixed income also experienced losses as interest rates globally moved up yet again

- In general, while the losses paled in comparison to the previous week, multi-asset investors continued losing capital

- Within equities, US large cap ended up flat with Value strategies outperforming Growth by 1.3%

- A 60/40 mix of purely US assets out-performed a global version and remains vastly ahead YTD

- In general, higher risk multi-asset strategies under-performed last week but remain ahead YTD

Currencies:

- The USD once again regained lost strength last week

- The Brazilian Real further recovered as a pro-business President is on deck

- EM currencies were mixed with the Peso and Yuan losing additional ground

- The British Pound lost about 1.5% last week as Brexit negotiations continue without a clear outcome

- The Yuan avoided being labeled a currency manipulator by the US Treasury but the trend is for further depreciation

Commodities:

- Commodity indices gave back some of the gains from the previous week as oil prices retreated

- Grain prices also retreated further but prices have stabilized from the bottom hit in the summer

- Sugar and Coffee showed the most gains aided by an appreciating Brazilian Real

- Gold and Silver were stable last week for a change but barring a real crisis continue on a downtrend especially in light of higher short-term interest rates

This Coming Week:

- US risky assets keep outperforming YTD but last week was a down week across the board except for REITS

- The worst performing asset categories are international equities with EM down almost 15% YTD

- The critical variable to watch for this week is the US 10 Year Note – another spike up and risky assets will be under great stress

- Our view is that volatility is here to stay

- In fact, we see current asset class volatility as normal

- We are also watching out for any strong jump in inflationary expectations

- Tariffs are inflationary and will be reflected in higher consumer prices eventually

- EM equities, in particular, are taking a huge hit both on the asset side as well as currency – this is turning out to be a lost year for EM investors

- We still believe that an allocation is warranted

- Value dramatically outperformed Growth last week and we are seeing faint signs of industry rotation toward value sectors

- The Momentum trade while still ahead YTD is quickly losing strength

- Earning season in the US is back with Amazon, Microsoft, and Google all reporting

- The biggest issue for investors is lack of a reasonable hedge to equity risk

To read our full weekly report please click here

Eric J. Weigel

___________________________________________________________________________________

Publications:

Weekly Asset Allocation Review – Free

Weekly Equity Themes Review – Free

The Equity Observer (Monthly) – Subscription Required

The Asset Allocation Advisor (Monthly) – Subscription Required