Value Investing is Teasing Us

- Value under-performed Growth last week in the US and abroad – some of this is sector driven

- Investors are losing faith in Value but should out-perform should the broad market tumble (lower beta)

- Global equities had a rough week under-performing bonds

- EM Equities continue under-performing YTD but last week lost the least (-0.3%)

- Our models have recently turned more cautious about EM stocks despite being much cheaper than their developed market counterparts

- Our top-rated asset class at the moment is International Developed Markets (EAFE) but last week was not good for this asset (-0.9%)

- Year-to-date US equities are vastly out-performing international assets – strong home bias fuelled by strong US growth plus an appreciating US dollar

- Momentum strategies are losing their effectiveness but remain top dog for the year

- There is no sign of fear among investors – our Risk Aversion Index remains in the Exuberant Zone

- We remain perplexed by this lack of concern especially as central banks are becoming less stimulative and the possibility of an all-out Global Trade War is rising

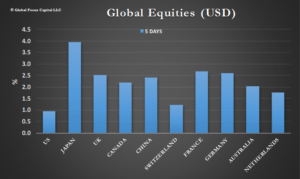

Countries & Region:

- Poor showing in the last 5 days with Japan being the only major market showing gains

- Equities under-performed bonds last week

- Growth out-performed Value over the last 5 trading days in the US as well as internationally

- Traditional Value sectors such as Materials and Financials gave up some of the gains from prior weeks

- Energy performed best in the US as well as in global indices

Style & Sector:

- In the US, mega-caps outperformed (lost less, unfortunately)

- Value once again under-performed Growth –mainly due to losses in the Materials and Finance sectors

- Growth and Momentum keep dominating YTD among US stocks

- Asian Developed markets (mostly Japan) boosted international market returns but EAFE was still down for the week

- EM LATAM recovered last week but trouble continues in the region (Brazil and Argentina)

This Coming Week:

- Risk Aversion continues to surprise on the downside – maybe old historical metrics don’t apply anymore? We don’t agree!

- Momentum and growth were kings once again last week – can this continue? Will Value only out-perform in a crisis?

- The battle may not be between growth and value – feels more like momentum versus reversal

- Tariff wars do not seem to have much of an effect on US stocks – will this persist?

- Small caps have quietly under-performed large caps over the last 3 months – has anybody noticed? YTD they are still ahead but barely

- Will EM equities recover? Seems to be all about the direction of the US dollar at the moment

To read our weekly report including style factor breakdowns please click here

Eric J. Weigel

Global Focus Capital LLC

eweigel@gf-cap.com

___________________________________________________________________________________

Publications:

Weekly Asset Allocation Review – Free

Weekly Equity Themes Review – Free

The Equity Observer (Monthly) – Subscription Required

The Asset Allocation Advisor (Monthly) – Subscription Required