“Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected”

– George Soros

- The seesaw continues for risky assets as small caps take the lead for 2019

- Over the last month, all major equity categories have lost money

- Surprisingly, EM stocks have held up the best in this equity correction

- Valuations while more reasonable than 3 months ago are not that favourable

- The key for equity markets is growth and whether we are entering a slowdown or not

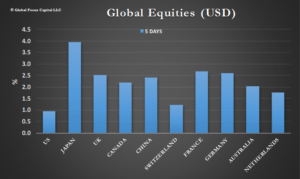

Countries & Region:

- A global recovery but with large differences in global market performance

- Commodity indices recovered last week as oil prices firmed up helping resource oriented markets

- In the US Value slightly outperformed Growth last week – higher quality and dividend yield also made a difference

- In international markets Value out-performed Growth by a wider margin than in the US

- Energy performed best and Tech did the worst (Apple effect)

Style & Sector:

- In the US, we saw a strong size effect last week with small caps dramatically out-performing

- Value performed a bit better than Growth

- Within equity styles, Quality and Div Yield strategies resulted in better performance

- The Momentum trade has gone in reverse with last year’s biggest loser performing the best thus far in 2019

- Latam shot up last week recovering from poor 2018 performance and the rise in oil prices

This Coming Week:

- Risk Aversion should stay high and we expect choppy markets this coming week again

- Equity Technicals have deteriorated to the point that close to 65% of stocks in the Down Trend Phase

- Political drama in Washington is exacerbating the uncertainty of market participants

- Brexit is up for the spring but prospects of passing Parliament are slim. Could we be staring at Referendum 2.0?

- Tariff wars are taking a bite with the IMF recently citing trade wars as the main reason for a cut in their forecast of global growth

- Small caps have massively under-performed large caps over the last 3 months but had a nice recovery

- Surprisingly EM equities have outperformed developed markets in the last month.

- Our models still favor a reduction in risk in our portfolios with positive active allocations to cash and bonds

- This too shall pass but market participants are hyper nervous on things companies have no control over

- The price of higher equity returns is discomfort – volatility has been too low in the last few years

To read our weekly report including style factor breakdowns please click here

Eric J. Weigel

Global Focus Capital LLC

eweigel@gf-cap.com

______________________________________________________________________________

Weekly Asset Allocation Review – Free

Weekly Equity Themes Review – Free

The Equity Observer (Monthly) – Subscription Required

The Asset Allocation Advisor (Monthly) – Subscription Required