Growth loses its edge as Momentum reverses

- The last month has been brutal for equity investors

- Higher rates contributed to this as well as slower expected global growth due to an escalation of tariffs

- Surprisingly, EM stocks are up over the last month but YTD remain the worst of the major equity categories

- YTD US large caps are barely in positive territory but US small caps are now down for the year

- The S&P 500 is up 0.2% for the year while the Russell 2000 is down 2%

- International strategies have underperformed both in local market returns and a strong USD

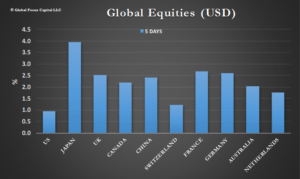

Countries & Region:

- The carnage continues –US growth stocks took a huge pounding last week

- Commodity indices took a beating last week (due to oil primarily) while the Real Estate market kept recovering

- In the US Value out-performed Growth over the last 5 trading by over 130 bp

- In international markets Value and Growth performed in line with each other

- Traditional Value sectors such as Utilities and Staples outperformed along with Health Care

- Technology and Energy were the two largest losers last week

Style & Sector:

- In the US, we saw a strong size effect last week with mega-caps under-performing

- Value once again out-performed Growth as the Utilities, Health Care and Real Estate performed well

- The Momentum trade has gone in reverse and Growth Stocks are key losers but remain ahead YTD

- Developed international markets were down the least last week but remain down 10% for the year

This Coming Week:

- Risk Aversion should stay high and we expect choppy markets this coming week again

- Equity Technicals have deteriorated to the point that over half of our US universe in is a Down Trend Phase

- Tax loss selling is likely to intensify in the next few weeks

- Tariff wars are taking a bite with the IMF recently citing trade wars as the main reason for a cut in their forecast of global growth

- Small caps have massively under-performed large caps over the last 3 months – risk is being shunned at the moment

- Surprisingly EM equities have outperformed developed markets in the last month.

- REITS have performed extremely well and are YTD our best performing asset class

- Q3 reporting is heavy in the US – looking for commentary on tariffs, slowing growth, and inflationary pressures

To read our weekly report including style factor breakdowns please click here

Eric J. Weigel

Global Focus Capital LLC

eweigel@gf-cap.com

___________________________________________________________________________________

Publications:

Weekly Asset Allocation Review – Free

Weekly Equity Themes Review – Free

The Equity Observer (Monthly) – Subscription Required

The Asset Allocation Advisor (Monthly) – Subscription Required