Just When We Thought That Value Was Dead

- Global equities once again out-performed bonds over the last 5 trading days

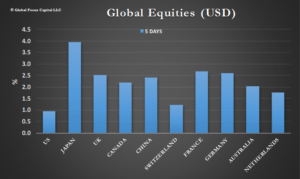

- Developed Market International Equities provided the best returns last week aided by a nearly 4% return to Japanese equities

- EM equities, while still on a downtrend, recovered somewhat last week (up 1.9%) but remain down nearly 9% for the year

- Our models have recently turned more cautious about EM stocks despite being much cheaper than their developed market counterparts

- Our top-rated asset class at the moment is International Developed Markets (EAFE)

- Year-to-date US equities are vastly out-performing international assets – strong home bias fuelled by strong US growth plus an appreciating US dollar

- Value outperformed Growth last week in the US and abroad – some of this is sector driven but we are starting to see signs of a quiet sector rotation going on in the market

- Momentum strategies are losing their effectiveness but remain top dog for the year

- There is no sign of fear among investors – our Risk Aversion Index remains in the Exuberant Zone

- We remain perplexed by this lack of concern especially as central banks are becoming less stimulative and the possibility of an all-out Global Trade War is rising

Countries & Region:

- Great last 5 days for global equities with Japan leading the pack

- Equities vastly out-performed bonds last week

- International equities and Emerging markets outperformed US equities

- Growth under-performed Value over the last 5 trading days

- Traditional Value sectors such as Materials and Financials made a comeback

- Utilities were the only sector in the red

Style & Sector:

- In the US, mega-caps outperformed

- Value for once out-performed Growth –mainly due to a recovery of the Materials and Finance sectors

- Growth and Momentum keep dominating YTD among US stocks but trailed last 5 days

- Asian Developed markets (mostly Japan) propelled the MSCI EAFE to a 7% return

- EM LATAM recovered last week but trouble continues in the area (Brazil and Argentina)

This Coming Week:

- Risk Aversion continues to surprise on the downside – maybe old historical metrics don’t apply anymore? We don’t agree!

- The bull market in US stocks remains intact but we are seeing evidence of some quiet industry rotation

- The battle may not be between growth and value – feels more like momentum versus reversal

- Tariff wars do not seem to have much of an effect on US stocks – will this persist? I

- Small caps have quietly under-performed large caps over the last 3 months – has anybody noticed? YTD it is a different story

- Will EM equities recover? Seems to be all about the direction of the US dollar at the moment with Argentina and Turkey inflicting further damage

- Are Chinese equities going to further lose ground or is this temporary? Is the downtrend due to tariffs or domestic growth issues?

To read our weekly report including style factor breakdowns please click here

Eric J. Weigel

Global Focus Capital LLC

eweigel@gf-cap.com

___________________________________________________________________________________

Publications:

Weekly Asset Allocation Review – Free

Weekly Equity Themes Review – Free

The Equity Observer (Monthly) – Subscription Required

The Asset Allocation Advisor (Monthly) – Subscription Required