Weekly Asset Allocation Highlights

- President Trump wasn’t the only one having a bad week – is this a Fake Correction?

- Cash is king once again but our risk aversion index is not picking up any fear

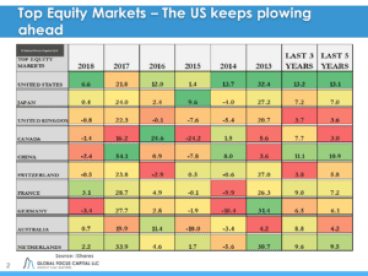

- US assets lost less last week if that is any consolation

- International equities lost the most value last week

- A 60/40 mix of purely US assets out-performed a global version once again

- Lower risk multi-asset strategies out-performed last week and are ahead in the last month

Currencies:

- The USD was range bound last week but continues in a technical Up Trend phase

- Within EM currencies the pattern was mixed

- The Rand continued depreciating while the Brazilian Real regained some ground versus the USD

- Within the major currencies, the yen outperformed

- The Yuan has stabilized after a period of depreciation but remains volatile within the “official” range

Commodities:

- Grains are getting whipsawed by trade war on/off issues

- Corn and soybeans continue being most at risk but regained some ground last week while Wheat continues deteriorating

- Oil is also getting whipsawed by political tensions – down over 3% last week after several up weeks

- Gold and Silver lost more ground last week and the trend is down especially as ST interest rates keep climbing higher

This Coming Week:

- Is cash the new King?

- Bonds and stocks are over-valued but growth still holding up which is positive for stocks but for how long?

- We still prefer risky assets but are lowering risk at the portfolio level.

- Are political issues in Washington of any concern to markets? Our risk aversion index is not picking up any concern at the moment.

- The strong USD keeps crushing investors in international assets but should be losing some momentum.

- International equities keep losing ground to US stocks despite superior fundamentals – becoming the contrarian play of 2018

- EM equities, in particular, are taking a huge hit both on the asset side as well as currency

- China has a lot to do with this given its weight in the MSCI index (30%)

- Growth is outperforming Value YTD but things may be turning around especially if interest rates remain range bound

- Global Tech has performed well this year but short-term it is in a break Down phase. More bad news to come or buy the dip? We are holding steady, not buying more.

- Gold and Silver are losing their luster – not providing downside hedge and very driven by trends in short-term rates

- What will make investors price risk more in line with history?

- A growth scare in the US, maybe? A real inflation scare? Waiting for Impeachment?

To read our full weekly report please click here

Eric J. Weigel

___________________________________________________________________________________

Publications:

Weekly Asset Allocation Review – Free

Weekly Equity Themes Review – Free

The Equity Observer (Monthly) – Subscription Required

The Asset Allocation Advisor (Monthly) – Subscription Required