Risk taking is in, but is risk underpriced again?

►The seesaw continues with risk assets doing particularly well this past week

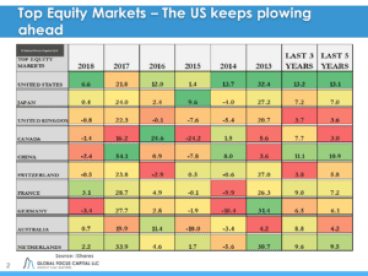

►US large caps performed best – up 2.9% for the week, but International Developed equities were only slightly

►Bond strategies delivered positive returns last week as well but significantly below those of more risky asset classes

►On a YTD basis, US small caps lead the pack by a slight margin – up 15.5%

►In the context of balanced 60/40 strategies US strategies and international strategies performed in line with each other (both up 1.9%)

►Aggressive focused multi-asset class strategies out-performed less risky options

►Within equities, Growth has slightly out-performed Value in 2019 and over the last year Growth also remains solidly ahead

►Thus far in 2019 more aggressive multi-asset strategies have outperformed less risky portfolios

Currencies:

►A rare down week for the USD as expectations for growth in the US slow down and the Fed remains on hold

►For 2019 we still expect the USD to depreciate slightly

►A depreciating USD will boost international asset returns – we expect this effect to persist in 2019

►A big question mark for this coming week is what happens to Brexit (yet again) – sterling is being massively tossed around depending on political prospects

►Interestingly, the pound has held up admirably during this period of uncertainty and is now in a Break Out phase

►The Yen is now in a Break Down phase as investors have regained their desire for risk

►In general, FX volatility has increased substantially in the last couple of months

Commodities:

►After a bad prior week, ag commodities rebounded strongly with wheat, the most beaten down of the group, up over 6%

►The tension in the grain complex is mostly supply driven but soybeans also are being affected by trade negotiations with China

►Commodity indices have moved into an Improving phase as oil markets have found some stability

►Gas was down slightly last week and remains in a Down Trend magnified by weak seasonality

►Copper kept its gains from the previous week as global growth only slows down slightly

►Gold and Silver were flat last week and are showing divergent patterns – gold being stronger than silver

►While inflationary expectations remain low, commodity prices are an excellent hedge should things change

This Coming Week:

►While risky assets have recovered we still think that risk is being shunned at the moment – investors seem uncomfortable making bold bets

►While not comfortable, US investors should consider allocating more money to non-US stocks due to their lower valuations and potentially a depreciating USD

►The strong USD will not persist much stronger as the FED appears close to the end in terms of interest rate hikes

►The Value/Growth discussion is being overshadowed by sector rotation but on a risk-adjusted basis we believe that higher allocations to Value are warranted

►We are also watching out for any jump in inflationary expectations (which have been trending down)

►Tariffs are inflationary and will be reflected in higher consumer prices eventually

►Our biggest concerns revolve around a slowing global economy – The IMF recently lowered 2019 growth numbers to 3.5%

►We still see a risk on/off market this year making it difficult for short-term investors – probably best to extend horizons

__________________________________________________________________________________

To read our full weekly report please click here

ic J. Weigel

______________________________________________________________________________

Publications:

Weekly Asset Allocation Review – Free

Weekly Equity Themes Review – Free

The Equity Observer (Monthly) – Subscription Required

The Asset Allocation Advisor (Monthly) – Subscription Required