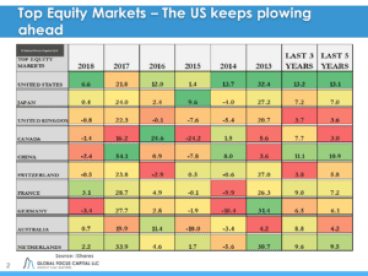

Global equity markets keep moving ahead despite the massive political noise. After falling in the middle of the pack last year, US equity markets remain in the pole position this year.

Some notable developments last week:

- The US lagged international developed and emerging markets as the US dollar took a bit of a breather

- Tech for once did not lead the markets. In fact, it was the worst performing sector. Facebook was the main contributing factor.

- Value and yield strategies rebounded strongly.

- Mega caps outperformed in the US.

- Most stocks were down last week but the cap weighting of broad indices made things look better. The S& P 500 was up 61 bp while the Russell 2000 was down almost 2%.

What we are watching this week:

- Lots of earnings in the US (Notables: Apple, Pfizer, Caterpillar, Tesla, Eaton)

- Risk Aversion – expect the RAI to jump into the Neutral Zone. Investors keep under-pricing risk

- Market Internals – expected to remain “balanced”. The technical do not support a bear market

- Q: What will US markets do after the strong 4.1% GDP growth? Will the long rate stand up?

- Will the US dollar give up some ground? The policy of super easy money seems to be coming to an end in JP and Europe

- Will Facebook rebound?

Interested in reading our full report?

Subscribe to our free weekly Equity Observer to get the report delivered to your email.

Eric J. Weigel