In the weeks leading up to the Brexit referendum vote our assumption was that while the vote would be close the “remain” side would eventually prevail. Our feeling was, I must admit, more based on our observation that under most circumstances electorates prefer to stay with the status quo.

In the weeks leading up to the Brexit referendum vote our assumption was that while the vote would be close the “remain” side would eventually prevail. Our feeling was, I must admit, more based on our observation that under most circumstances electorates prefer to stay with the status quo.

My relatives in the UK had warned me against making such an assumption, but from a pure economic perspective the evidence seemed stacked in favor of remaining within the EU.

Now that we know the outcome of the vote and Brexit has become a reality it downs on me how out of touch we can sometimes be when dealing with unhappy electorates. The evidence is scant for any positive economic benefit for separation from the EU, but the hope for change is sometimes so strong so as to overwhelm rational thought. In my opinion, while the world may have recovered economically from the depths of the 2008 Financial Crisis the seeds of discontent are still alive within large segments of the population.

The rise of nationalism in many countries is tied to the search for simple solutions for promoting adequate growth in the face of weak labor markets and rising income inequality. These simple solutions are often expressed in the form of isolationist strategies with the underlying assumption being that inadequacies in economic growth are caused by outside forces.

But just as building a moat around one’s castle is a totally inadequate way in today’s world to keep outside influences at bay so are policies pretending that world economic forces can be neutralized at one’s door step.

Markets for goods and services today are truly global in nature and while pockets of every economy will remain domestically driven the vast majority of global economic activity takes place in the context of highly competitive supply and demand conditions involving companies frequently conducting business from multiple geographies. Borders don’t matter as much as the ability to offer a value proposition to both producers and consumers.

The 52% of voters in the UK that voted for pulling out of the EU are betting that the UK economy will be better off long-term not being part of the larger economic union. Stifling regulations imposed by the EU are one shackle that UK domiciled companies will no longer have to bear. Another, it is argued, will be removing the burden of subsidizing weaker members of the union.

But while the long-term ramifications of Brexit will not be known in totality for at least a decade or two the shorter-term issues are likely to wreak havoc with investor sentiment. “Risk-off” is likely is to stay with us for a bit longer than expected!

Another Brexit casualty will be sterling denominated assets. Not only will the British Pound depreciate significantly but the demand for UK domiciled stocks and bonds will decrease as well. Sellers will remain highly incentivized so prices will need to drop for buyers and sellers to meet. None of this is rocket science and markets on t+1 are already reflecting these negatives.

While the short-term implications for UK equity owners are negative we do not believe that Brexit will lead to the end of the world. After all our belief is that company fundamentals drive long-term investor rewards and spikes in investor sentiment both positive and negative appear as mere blips in long-term performance charts.

Especially for companies not directly tied to the regulatory consequences of Brexit the news may be good in the short-term as investors express an increased preference for lower uncertainty situations. Even for many UK companies the news does not constitute a death sentence as many already conduct operations in geographically diversified locales. For some export-driven companies the depreciation of the pound will provide short-term competitive advantages.

UK-domiciled assets will not doubt remain under pressure for the foreseeable future. Withdrawing from the EU bloc is fraught with technicalities and will require the negotiation of dozens of trade agreements. Article 50 of the Lisbon Treaty will have to be invoked which will then allow for a two year period of negotiation between the EU and the UK government. Pro-Brexit politicians have openly discussed delaying invoking Article 50 leading to most likely a period of 4 to 5 years of uncertainty. While the Brexit side rejoices today the withdrawal from the EU will not be immediate.

Most times when a political event such as Brexit occurs the size of the overall economic pie does not change materially at least over short and intermediate terms. What tends to happen instead is that the pie gets splits up differently creating losers and winners.

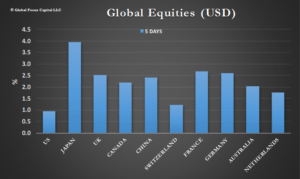

Capital markets are reacting post-referendum as if the size of the pie has permanently shrunk and everybody will go hungry. The reaction of global capital markets would suggest dire consequences for global growth. Risky assets are getting uniformly destroyed and investors are flocking to safe heavens such as the US dollar, long-term US government bonds and precious metals.

Our view is that while global economic growth will experience a hiccup the longer-term effect for global growth will not be significant. For long-term investors with multi-asset class portfolios we do not expect a lasting effect from Brexit but understanding the likely short-term winners and losers could actually yield some very rewarding tactical trades.

In many ways this crisis while most likely painful for the UK economy resembles other periods in history when political events led to a spike in capital market volatility and a rise in investor risk aversion. Such periods were uncomfortable for investors but also yielded tremendous opportunities to add value.

What can we reasonable expect over the next few weeks?

- Investor risk aversion will remain elevated as investors seek to understand the long-term implications of Brexit

- The US dollar, Swiss Franc and the Yen will strengthen at the expense of the Euro and the British Pound

- Commodities apart from precious metals will face downward pressures as the US dollar appreciates. We, however, believe that oil will find its footing reasonable soon as supply/demand conditions seem to be close to equilibrium

- Investors will increase the demand for high quality bonds leading to further interest rate decreases. Long duration bonds will benefit the most. Interest rate sensitive assets such as real estate will likewise benefit.

- The US Federal Reserve will not raise rates in July and we would be surprised if they institute any hikes this year. The ECB and the Bank of England will cut rates and increase monetary stimulus. Global liquidity will remain plentiful.

- Investors with short time horizons will flee risky assets en masse. We should expect outflows from equities to accelerate in the short-term. European and UK portfolios will see the sharpest outflows

- Extreme contrarians will advocate buying into UK equities but there will be few takers. We would advocate passing on this trade for now

- Contrarians will also advocate buying stocks domiciled in the US. Such a trade won’t require, in our opinion, as long as of a time horizon as buying UK stocks and it will thus entail less risk. Our two top equity tilts remain low valuation and above-average company profitability

In general, we would advocate making only small adjustments to multi-asset class portfolios. The adjustments would be more driven by risk management considerations as we expect asset class volatility to remain elevated for the remainder of 2016. Our risk aversion index (RAI) has also recently moved into the “extreme fear” zone thus calling for a more defensive risk posture.

From a tactical perspective we see opportunities emerging more from bottom-up stock selection activities rather than from sector or country allocation decisions. When whole markets sells off as we saw on the day after Brexit the good gets thrown out with the bad.

In a crisis company fundamentals are often ignored as investors are forced to sell their most liquid holdings first. Market turmoil tends to create attractive entry points for investments with robust long-term fundamentals. We expect global equity markets to remain under pressure next week and we would thus advocate waiting a bit longer to put any excess cash to work.

Eric J. Weigel

Managing Partner, Global Focus Capital LLC

Feel free to contact us at Global Focus Capital LLC (mailto:eweigel@gf-cap.com or visit our website at https://gf-cap.com to find out more about our asset management strategies, consulting/OCIO solutions, and research subscriptions.

DISCLAIMER: NOTHING HEREIN SHALL BE CONSTRUED AS INVESTMENT ADVICE, A RECOMMENDATION OR SOLICITATION TO BUY OR SELL ANY SECURITY. PAST PERFORMANCE DOES NOT PREDICT OR GUARANTEE FUTURE SIMILAR RESULTS. SEEK THE ADVICE OF AN INVESTMENT MANAGER, LAWYER AND ACCOUNTANT BEFORE YOU INVEST. DON’T RELY ON ANYTHING HEREIN. DO YOUR OWN HOMEWORK. THIS IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSIDER THE INVESTMENT NEEDS OR SUITABILITY OF ANY INDIVIDUAL. THERE IS NO PROMISE TO CORRECT ANY ERRORS OR OMISSIONS OR NOTIFY THE READER OF ANY SUCH ERRORS